- Are funeral expenses tax deductible in 2021 how to#

- Are funeral expenses tax deductible in 2021 professional#

- Are funeral expenses tax deductible in 2021 free#

This means that if you pay the costs of your loved one’s funeral out of your own pocket, you cannot deduct the expenses on your income tax return (IRS Form 1040).

Individuals cannot claim funeral and burial expenses on their individual income tax return. When To Deduct Funeral ExpensesĪccording to the IRS, funeral and burial expenses are only deductible if paid out by the decedent’s estate.

Are funeral expenses tax deductible in 2021 professional#

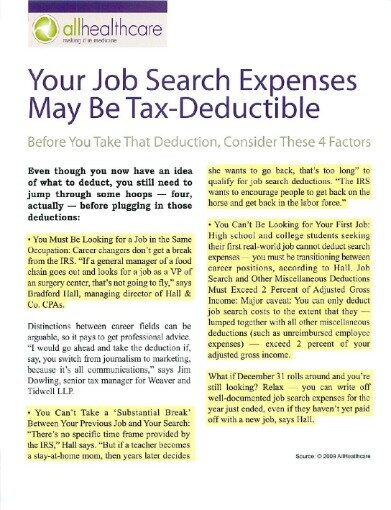

We recommend that you consult a tax professional or estate attorney to get the most accurate and current information however, read on to get an answer to this incredibly complicated question. The question of whether funeral expenses are tax-deductible will likely come up, and it makes sense to get a clear understanding of the tax rules before final payment is made.

Thanks to Shannon Warawa of KWB Chartered Professional Accountants for providing this content.“Nothing can be said to be certain, except death and taxes.” This famous phrase seems particularly relevant when planning a funeral for a loved one.

Are funeral expenses tax deductible in 2021 free#

If you would like more information or have any questions, feel free to contact us at 780.466.6204, or click here to send us an email. The slip will be reported on that person’s return, but is not taxable. The slip must be filed by the normal deadline for filing T slips, February 28 th. The amount of the payment should be reported in box 106 of a T4A slip and the slip issued to the individual or estate receiving the payment. The payment received will be considered non-taxable to the beneficiary but deductible to the corporation. If you have any other questions regarding the CPP death benefit, please call Service Canada at 1-80.Ī corporation is also able to pay a survivor benefit of up to $10,000 to an employee’s estate or their beneficiary in recognition of that employee’s service or employment. Payment from Service Canada takes approximately 6 to 12 weeks from the date the application is received.

Are funeral expenses tax deductible in 2021 how to#

Information including how to get started, eligibility and acceptable documents for proof of death to send with your application, along with a fillable copy of the application form, are available here. Whether reported by the Estate or an individual, it is advisable that some amount of the benefit be reserved to cover the tax payment once the income tax return is filed.įor more information on the CPP death benefit, please visit the Government of Canada website.įor information on how to apply for the CPP death benefit, please visit Service Canada’s website. The CPP death benefit cannot be reported on the final T1 personal tax return of the deceased person. If received by an individual, the benefit is reported on line 114 of that individual’s personal tax return and the taxes payable on the benefit would depend on the income tax bracket that individual is in. A $2,500 CPP benefit generates $625 in taxes payable by the Estate. If received by the Estate, the benefit is reported on the CPP death benefit line of the Other Income and Deductions schedule on the T3 Trust income tax return. The CPP death benefit is taxable and must be reported by the deceased person’s Estate or the individual(s) who receives it. Professionals at Will Writing London will be able to help you figure this out. There is no time limit on when you can apply. If this person applies before the Executor and after the first 60 days, the benefit will go to them. After the 60 days, someone else can apply for the CPP death benefit, for example, the person who paid for the deceased’s funeral expenses. Only the Executor can apply in the first 60 days after death. The Executor is the first person that can apply for the CPP death benefit. A surviving spouse or common law partner.The person who paid the funeral expenses.The CPP death benefit is a one-time, lump-sum payment to the estate of the deceased contributor.

0 kommentar(er)

0 kommentar(er)